A “legacy plan” is the story of You: your life, your wisdom, and your desires. A legacy plan includes ordinary estate planning but goes far beyond simply having some legal documents.

The traditional way of making sure an end-of-life process was mapped out involved a piecemeal approach. It used to be that an individual would get a Will along with a Health Care Directive and/or a Power of Attorney and maybe a life insurance policy and that was all there was to estate planning.

Communicating personal wishes and choices with family members about caregiving and end-of-life decisions was typically said casually and as a comment in passing; “Should something happen to me, remember all the important papers are in the top drawer of the chest.”

This was my experience with my parent’s estate planning. I thought we were all set. Little did I know that there was much more to consider and that the long dementia journey we traveled could have been less costly: financially, physically, and emotionally. But when we’re in the middle of something you don’t know – you don’t know what you don’t know.

I didn’t know the costs associated with caregiving: nursing homes, in-home care, loss of personal expenses, medical expenses, physical exhaustion, the emotional drain, and final expenses. But I learned.

I learned that early planning, well organized, and done with a professional can turn the end results of losing a loved one from an overwhelmed, exhaustive blur into a beautiful memorialized celebration of their wisdom, their life, and most importantly, their love.

As I stood beside my father’s casket unable to grieve because I was worn out every which way this side of Sunday, I decided to help others have a positive experience. I want others to have a healthy experience, a better experience than I had.

I set out on a very naïve mission to help other adult children of aging parents and their families examine, plan, organize, and communicate in a healthier way. As I said, I was very naïve but I kept learning. I kept asking questions about how to make this process better and smoother. I learned two very important things that stood out to me.

Of course, I learned many more things than two, but I want to focus on those two lessons because they are more about emotions than practical, legal things.

People overwhelmingly told me they wished they had recorded the memories, stories and “sayings” of their loved one. Even people who were oftentimes at odds with their loved one, told me they longed for a tangible remembrance of the interactions that were positive.

The other lesson was more about the parent, senior adult, loved one. These folks, also in an overwhelming number repeated, “I don’t want to be a burden!” This common refrain echoes throughout all age groups, all faith systems, all familial roles, and all socio-economic levels. Even narcissistic, emotionally challenged individuals expressed this sentiment.

I did run into a few individuals who let me, and their families, know that they weren’t going to plan for any end of life eventualities. With a touch of unresolved anger and a splash of venom, these folks told me, “I’ll be dead; they can figure it out.”

But again, most people don’t want to be a burden and most people make at least a minimal amount of arrangements. When I say minimal – I mean they “tell” somebody what they’d prefer happen for the second half and end of their life.

One’s ability to remember what they were told is not always helpful and often conflicts with what another family was told or remembers.

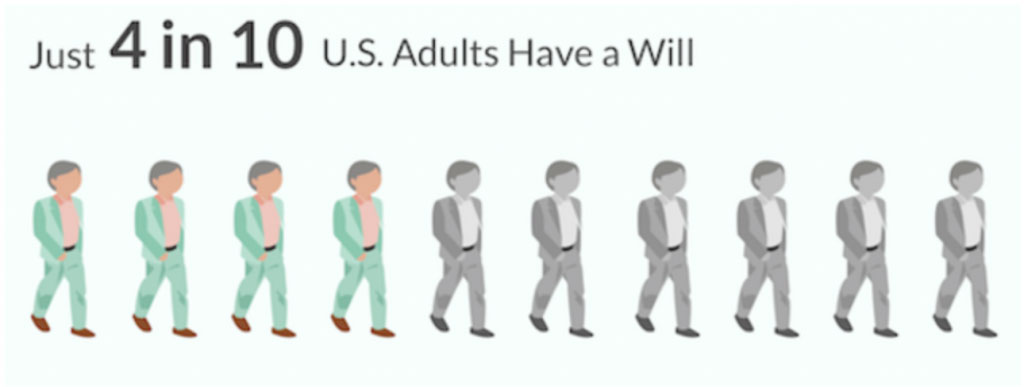

According to a new Caring.com survey, only 42 percent of U.S. adults currently have estate planning documents such as a will or living trust. For those with children under the age of 18, the figure is even lower, with just 36 percent having an end-of-life plan in place.

“I think many Americans avoid setting up a will because they simply don’t want to think about their death,” says Texas-based financial coach Craig Dacy. “However, setting up a will not only takes care of your loved ones financially, it can save them a lot of emotional stress after you’re gone.”

The study, conducted in January by Princeton Survey Research Associates International, asked 1,003 adults whether they currently have estate-planning documents in case of their death, as well as the reason why not (if applicable).

Forty-seven percent of survey respondents without estate documents said, “I just haven’t gotten around to it.” This is unsurprising to experts, who say an aversion to end-of-life planning is not only rooted in fear but also procrastination.

“This is the ‘I’m going to live forever’ theory. No one literally thinks that, but we all want to believe we are going to live until our 80s or 90s so we don’t think we need a will right now,” says Debbi King, author of “The ABC’s of Personal Finance”. “This isn’t true, of course. We all have an expiration date and no one knows exactly when it will be. The best thing you can do for your loved ones is have a will [Legacy Plan] now.”

With these two emotional lessons I learned about people wanting stories and loved ones not wanting to be a burden, I threw in the statistics of 42 percent of people not having estate documents and viola, The Guardians Gift was born and my mission began.

My Mission is to help individuals and their families gather their stories, all while providing guidance and support so that a Legacy Plan is created. The legacy plan contains the documents of an estate plan as well as information about an individual’s life that would not be found in a “document.”

My Mission is to help provide relief for loved ones; relief from the burden of emotional decision making, undirected caregiving choices, and financial insecurity.

The Guardian’s Gift will provide a loving and peace filled last gift of legacy and wisdom for your family.

This is your gift of love that extends beyond life.

~Dr. Judy H. Butler, PsyD